New ITR Forms

New ITR Forms

New ITR Forms released by Income Tax Department! Deadline extended till 31st August!

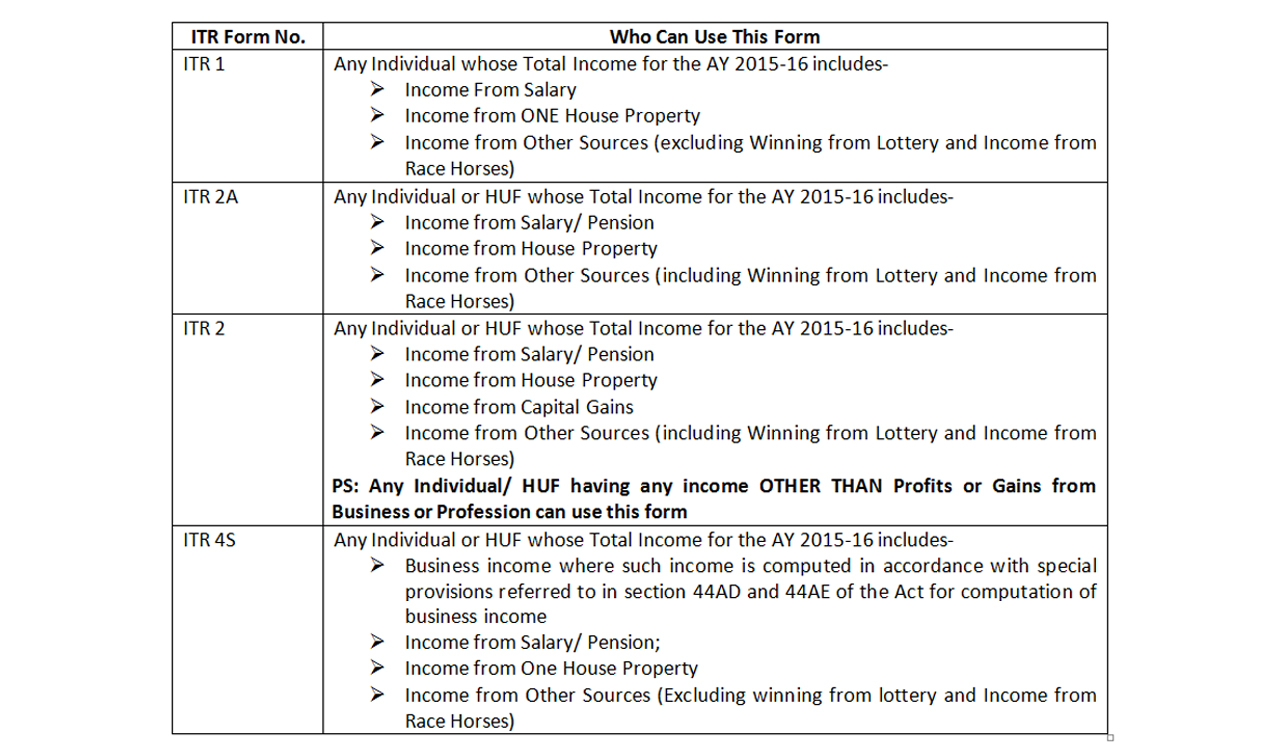

CBDT has notified the new and simpler Income Tax Return Forms vide Notification No. 49/2015 dated 22nd June, 2015. A list of the forms notified so far

- The major changes made in the form are:

- The IFS Codes and Account Numbers of ALL Bank Accounts operative at any time during the previous year need to be furnished. However, details of Dormant Accounts inoperative since past 3 years need not be given.

- Passport Number and AADHAR Number if available need to be provided in the returns.

Tax Payers can start the e-filing of forms ITR 1 and ITR 4S. However, the excel utility of ITR 2 & ITR 2A is yet to be made live. To the relief, the due date of filing Income Tax Returns has been extended from 31st July to 31st August.

For ITR Filing and other auxiliary services log on to www.dcstax.in or Call us @ +91 98363 88555.